The intersection between finance and data-driven technology is becoming more crucial than ever.

Asset managers, traders and analysts use Graphext to design data-driven strategies and extract information about markets, currencies and portfolios without writing code. Analyze and segment financial assets or implement forecasting and clustering models to interrogate patterns behind accounts, identify opportunities and forecast market trends.

Projects

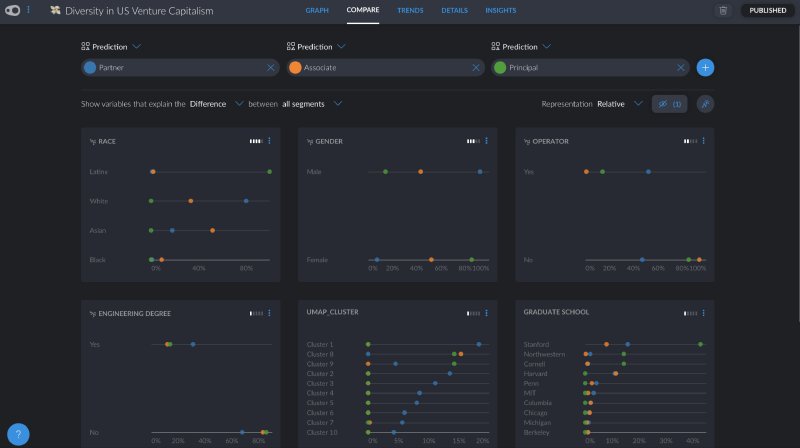

Diversity in U.S. venture capital.

This project reverse engineers the characteristics of 1,500 U.S. venture capitalists. Our model considered characteristics such as educational background, gender and race of venture capitalists to predict their job seniority.

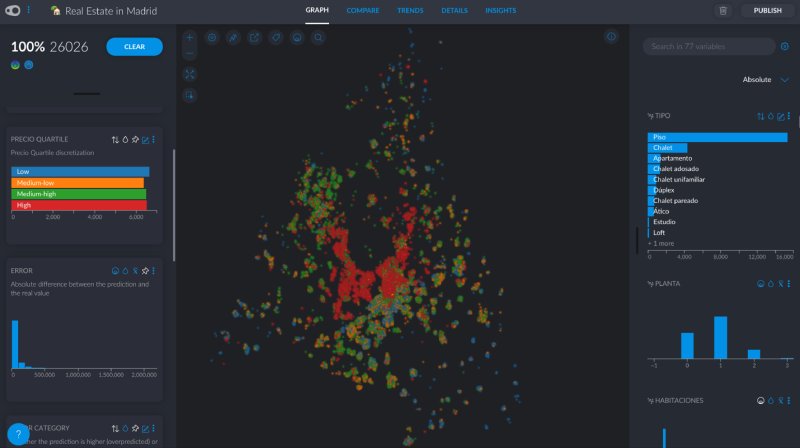

Real estate opportunities in Madrid

A geospatial analysis of real estate offers in Madrid. This project uses the enrichment and prediction of socio-demographic data to expose hidden opportunities in Madrid’s real estate sector.

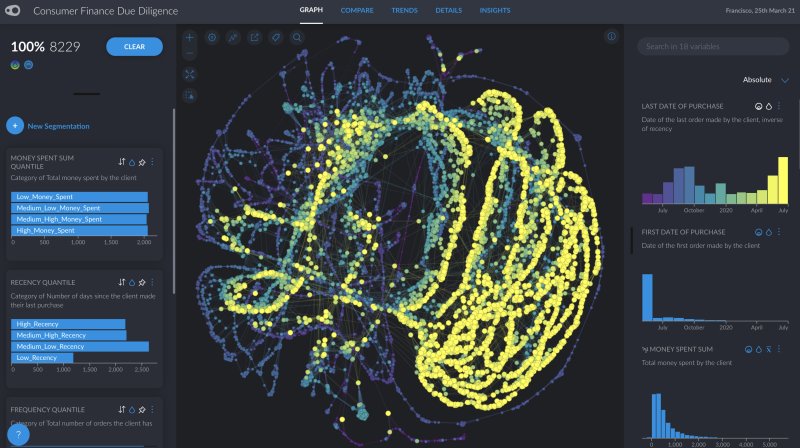

Consumer finance due diligence with Menhir.ai

In this project Menhir used Graphext to segment the assets belonging to a loan portfolio. They exposed sub-communities in the data by grouping assets according to the timeliness, frequency, longevity and amount of their payments.

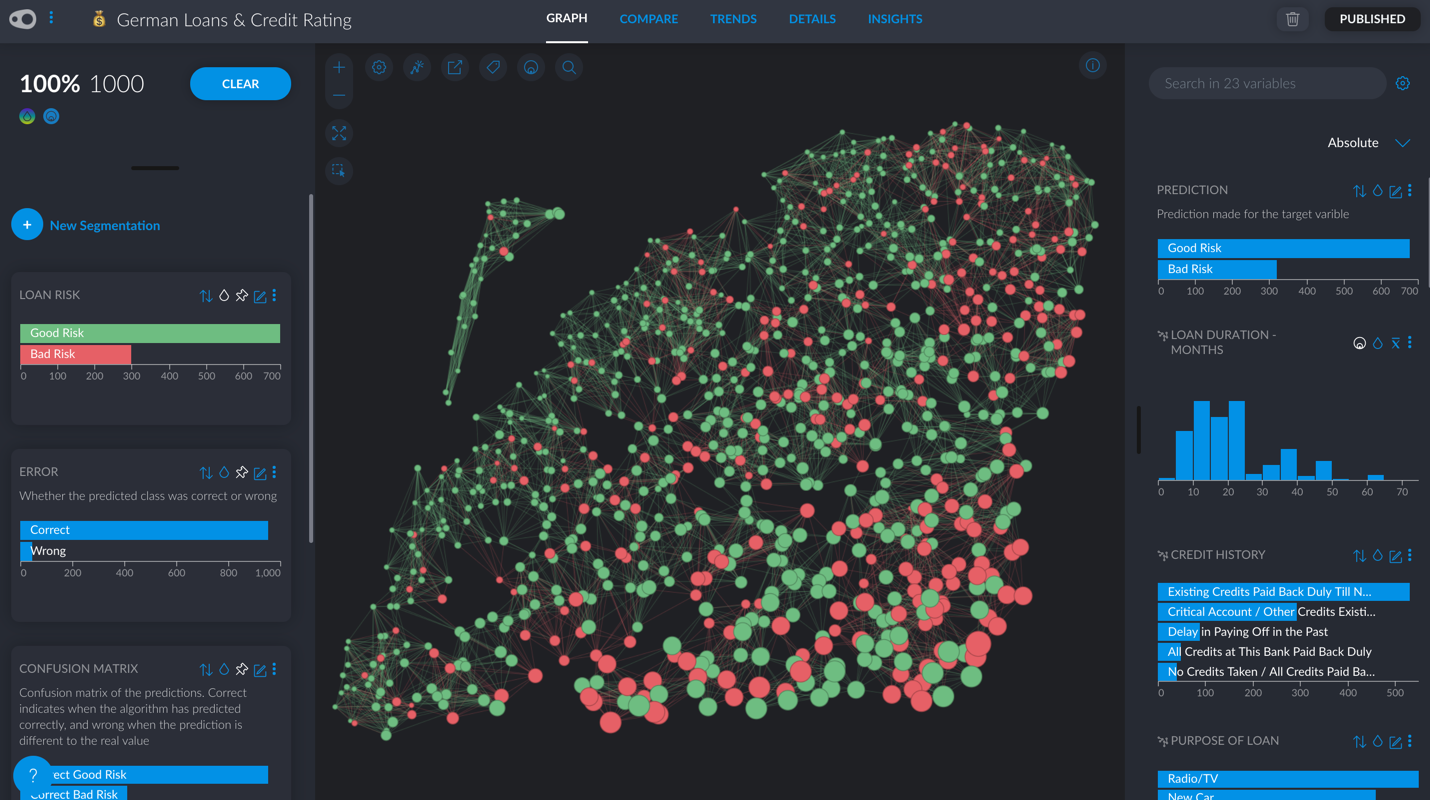

Loans in Germany and credit rating

This project reverse engineers the characteristics of 1000 German loans to understand the most influential characteristics for lenders and banks when considering the risk profile of an application.